Shipment on Credit

Order goods ranging from 1,000 ₴ to 100,000 ₴, pick up your order at the branch immediately, and pay for it throughout the year.

Citizens of Ukraine aged 18 to 65 who send or receive payment on delivery orders at least once every six months can apply for the "Shipment on Credit" service from NovaPay Credit at Nova Post branches.

How to use the service

S T E P 1

Select the item you need in the online store, check your credit limit, and order this item to the branch with payment on delivery.

You can get a single credit for several shipments at once if their total value does not exceed your credit limit.

S T E P 2

Visit the branch with your passport and TIN certificate and tell the operator you want to pick up the shipment on credit.

It usually takes up to 5 minutes to get a shipment on credit at a Nova Post branch.

S T E P 3

Provide documents, sign the contract, and pick up your order.

S T E P 4

Pay the amount in equal installments within 12 months.

How does it work

- 1When credit is granted, funds are transferred to the seller's account. This payment is nothing different from a regular payment on delivery.

- 2The recipient of the goods (the person receiving the shipment on credit) will be indicated as the payer in the EW.

- 3Only the person indicated as the recipient of the shipment can receive the shipment on credit. The terms of the service exclude the possibility of getting a credit by power of attorney.

- 1You can get a credit after inspecting the goods. First, check the order and, if it is satisfactory, sign a credit agreement. NovaPay Credit pays for the shipment, and you pay NovaPay Credit back within a year.

- 2You can get a new shipment on credit within your personal credit limit even if the previous one has not yet been paid in full.

What goods and for what amount can be ordered on credit at Nova Post

You can get on credit any goods delivered by Nova Post with payment on delivery worth from 1,000 ₴ to the amount specified in your personal credit limit. Delivery costs and transfer fees are included in the credit amount.

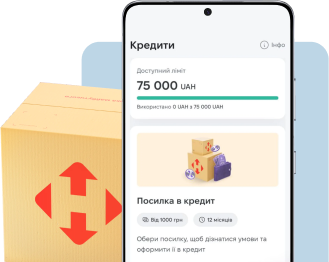

How to check your credit limit

In the Nova Post mobile app

In the NOVAPAY mobile app

At the branch

On store websites

look for NovaPay among the available credits

How to pay your credit

The payment schedule is described in the credit sheet. You will get a link to it in the message when applying for a credit.

The personal credit limit is determined automatically. Its amount is based on the number and value of the payment on delivery orders you have received from Nova Post over the past 6 months, your credit history, monthly income, and other factors affecting your ability to pay.

How to estimate the cost of a shipment on credit

For example, you want to buy a tablet for 10,000 ₴ on credit...

You can estimate the total cost of the credit in the credit calculator →

How to pay a third-party's credit

Any person can make a scheduled payment, repay the debt, or settle the credit in full for the borrower. If the borrower has several credits with NovaPay Credit, the agreement number specified in the credit application will be required.

At the Nova Post branch

The payer must provide the borrower's last name, first name, patronymic, and phone number. To pay 5,000 ₴ or more, the payer must provide his/her passport.

At any bank or online service

The payer must provide the payment details specified in the credit application.

Service restrictions and conditions

- 1Credit amount — from 1,000 ₴ to 100,000 ₴

- 2Credit repayment period — 12 months

- 3Without a down payment

- 1The rate — 0.00001% per annum

- 2Real annual interest rate — 100.96%

- 3Fee — 3.5% per month

You can find details on all terms and payments in the documents generated when applying for a credit.

The credit is provided by NovaPay Credit LLC, an entity of the NovaPay Financial Group and a member of the NOVA Group of Companies. The company holds all the necessary licenses and permits from the NBU.

The NovaPay Credit LLC license to lend funds, in particular as a financial credit, was issued by the order of the National Financial Services Commission No. 163 dated January 26, 2017.

- As required by law (Law of Ukraine "On Consumer Lending" - Article 6, Law of Ukraine "On Financial Services and Financial Companies" - Articles 6, 7), credit intermediaries must place a certain scope of information on credits on their websites, mobile apps, and in all premises intended for the provision of relevant services.

Details of a credit intermediary acting as a credit agent:

NOVA POST LIMITED LIABILITY COMPANY; 103 Stolychne Shosse, building 1, floor 9, Kyiv, 03026, Ukraine; USREOU code: 31316718.Name of the lender on whose behalf the credit intermediary acts:

NovaPay Credit LIMITED LIABILITY COMPANY.A list of services offered by a credit intermediary:

- 1Informing/consulting the Clients on the terms and conditions of the Credit, the terms and conditions of the Credit Products, including providing full details of the credit terms and conditions, other mandatory information to the extent required by the legislation of Ukraine;

- 2Informing the Lender about the Client's intention to apply for a Credit and providing all the necessary information according to the Lender's credit policy to make a decision on granting/refusing to grant a Credit;

- 3Informing the Client about the decision made on the possibility of granting the Credit.

Consideration (commission fee) or other charge for credit intermediary services: provision of credit intermediary services to Clients is not charged.

Information on protection mechanisms for consumers of financial services

Clients of NovaPay Credit LLC are entitled to all the mechanisms for protecting the rights of consumers of financial services stipulated by the legislation of Ukraine and set by practice, including through:- 1Pre-trial conference.

The consumer may contact NovaPay Credit LLC with complaints, observations, claims, and statements regarding financial services.

Complaints from consumers of financial services are accepted:

– at the postal address: 103 Stolychne Shosse, building 1, floor 13, office 1307, Kyiv, 03026;

– by email at office@novapay.ua;

– by phone 0 800 30 79 30 on business days (except Saturdays and Sundays), working hours: from 9 a.m. to 6 p.m;

– using the "Questions to NovaPay Credit" form (by selecting the "Complaint" subject of the inquiry) in the "Write to us" section of the financial institution's website.

More details by following the link - 2Application to the authorized state authorities for protection

of violated rights.

State regulation of financial services markets regarding non-banking financial services is carried out by the National Bank of Ukraine. The "Enquiries from Citizens" section of the NBU's official website is available at https://bank.gov.ua/ua/contacts. - 3Application to the court as prescribed by applicable law.

The consumer is entitled to apply to the court to protect his or her violated, unrecognized, or disputed rights, freedoms, or legitimate interests. The right to judicial protection may be exercised by filing lawsuits in court in Ukraine according to the legislation of Ukraine and the relevant agreement concluded between the Consumer and NovaPay Credit LLC.

Need any help?

Answers to frequently asked questions

- What you need to get a shipment on credit

At the Nova Post branch:

To get a shipment on credit, you need a payment on delivery shipment ranging from 1,000 UAH to the amount specified in your personal credit limit.

You need the originals of your passport with a residence registration and TIN certificate or the same documents in the Diia app. Please note that both documents must be of the same type: either originals or in the Diia app.

You need the phone number the shipment was ordered to. You will receive a message with a password to sign documents electronically.

Your consent to check your credit history will also be required.At the NovaPay app:

To register a shipment on credit, you need a payment on delivery shipment ranging from 1,000 UAH to the amount specified in your personal credit limit.

Install the NovaPay mobile app on your phone, complete the onboarding procedure, and open an account with NovaPay LLC.

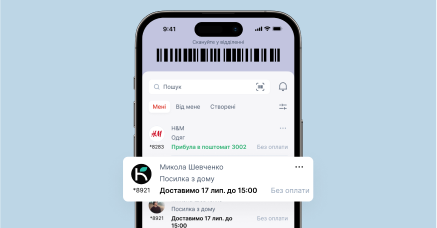

Switch to the "Credits" tab at the bottom of the screen and click "Select Shipment". Or you can go to the shipments menu (EWs). Select the desired shipment worth over 1,000 UAH to get a credit.

Review the credit terms and conditions and click "Get a Credit". Read the credit documents and click "Sign".

You will receive a message on your phone with a password to sign documents electronically. Enter the received password in the app.

Once you see the message on the screen informing you of the successful credit approval, you can pick up the shipment at the branch or shipment locker. - Will you check my credit history

Yes, when applying for credit at the Nova Post branch, you must authorize NovaPay Credit to receive your credit history. We strive to assist customers with a positive business reputation and no outstanding financial liabilities.

- Why don't I have a credit limit to pay for shipments at Nova Post

We likely lack sufficient data to determine your credit limit. The credit limit is estimated automatically based on the number and value of the payment on delivery orders you have received from Nova Post over the past 6 months, your credit history, monthly income, and other factors affecting your ability to pay.

If you are unable to get a shipment on credit right now, check your credit limit in 1 month. - Can I repay the credit ahead of schedule

Yes, of course. You can repay the credit in full ahead of schedule with no additional fees and interest by paying only the current month's credit fee.

When making a cash payment in a branch worth 5,000 ₴, bring your passport and show it to the operator. - What if I pay more than the amount scheduled

If you pay an amount in excess of the scheduled payment, the excess will be applied to repay the principal (body) of the credit.

As the total debt is reduced, we will adjust the payment schedule. All subsequent payments will be evenly decreased. The credit term will remain the same.

You can print out the updated repayment schedule at any Nova Post branch. - How can I repay the credit in full ahead of schedule and how much does it cost

To repay your credit ahead of schedule:

- 1Check the amount you owe to make a full repayment. You can do this in the NovaPay mobile app, the Nova Post mobile app, any Nova Post branch, or the contact center by calling

0 800 30 79 30. - 2Pay this amount wherever it is convenient for you: in the NovaPay mobile app, the Nova Post mobile app, at the branch, bank, or other financial institution to the details. When making a cash payment in a branch worth 5,000 ₴, bring your passport and show it to the operator.

In case of full repayment, only interest for the actual number of installment days (0.00001% per annum) and a credit service fee of 2.5% of the borrowed amount for each month are charged.

There are no additional fees or penalties for paying ahead of schedule. - What if the borrower is enlisted in the military

We express our sincere gratitude to everyone who took up arms to defend Ukraine.

Military borrowers are exempt from paying interest on their credits. They are also exempt from fines and penalties for late repayment of the credit.

These allowances are stipulated by the law "On Social and Legal Protection of Military Personnel and Members of Their Families."To get the allowance, the borrower or their close relatives must declare military service and provide documents to prove it:

- 1A military registration card, in which service marks are made in the relevant sections;

- 2Or a conscription certificate issued by a military enlistment office or military unit;

- 3An extract from the order or a certificate of enrollment in the military unit for reservists.

You can report it in any way convenient for you:

- 1To the E-mail at mobilized-kredit@novapay.ua

- 2By mail to 103, Stolychne Shosse, Kyiv, 03026, building 1, 13th floor, office 1307

- 3By phone at 0 800 30 79 30

Please specify the borrower's name and TIN, as well as the credit agreement number.

- How can I check the amount of the current debt and the amount of the next payment

You can check the amount of debt, the amount and date of the next payment, and other information about the credit:

- 1In the NovaPay mobile app. To do so, go to the "Credits" tab at the bottom of the screen. Select the one you need from the list and go to the credit details. Here you'll see the amount owed, the amount and status of the current payment, and the date it's to be paid.

- 2In the Nova Post mobile app. To do so, open your account in the app, select the "Shipment on Credit" tab, and then go to "Current Credits".

- 3In the Nova Post branch or by calling the contact center at 0 800 30 79 30 to check the amount to be paid in full, the amount of the current payment, and the existing debt.

When visiting a branch, please provide your passport or other ID document. You can confirm your identity with a paper passport, ID card, or the Diia mobile app. Find more details on the Verification page.

To call the contact center, use the phone number to which the credit was registered. - Can I check the status of the current debt for another person

For security reasons, we disclose credit information only to the person who applied for the credit.

- Can I get a certificate of full repayment of the credit

Yes, of course. Please call the contact center at 0 800 30 79 30 and fill out an application.

To call the contact center, use the phone number to which the credit was registered.